Have you ever asked yourself, how much should I spend a month? Well, Dave Ramsey has helped us with the answers to these questions with his recommended budgeting percentages.

Dave Ramsey, author of Total Money Makeover and personal finance expert, may not be everyone’s cup of tea, but he, without a doubt, made personal finances practical, easy to follow, and easy to understand. Which, for “non-finance”, people is super enticing!

[cboxarea id=”cbox-mvQDRtAuVggGJt5r”]

One of the first times I remember hearing about Dave Ramsey was back when I was fresh from the nest and living on my own. I remember searching for “easy ways to budget money“.

While I knew budgeting was important, I wasn’t too sure about where to start or even what best practices looked like!

Money can be hard. Budgeting can be hard.

So what is the best way to manage your money? Let’s jump into his basic budgeting bumpers (Alliteration for the win!) and plan for success with our household budget.

Table of Contents

Why Do I need a Budget?

No matter what your financial situation, you need a budget.

Budgeting is the financial roadmap for your life.

You need a budget:

- If you are trying to pay off credit card debt or pay off any debt for that matter!

- If you are trying to cut back on spending money.

- If your living expenses are out of control and you need a better way to manage them.

- If you need help trying to figure out how to best spend your paycheck every month.

- If you want help tracking your bills.

I could probably list another 20 reasons off the top of my head– you get the picture.

Budgeting helps to ensure you reach your financial goals!

So, let’s see what Dave recommends for your household budgeting percentages.

Budgeting Your Money with Dave Ramsey’s Budget Percentages

New to budgeting? Maybe you aren’t new to budgeting but have previously been unsuccessful.

Dave’s budgeting percentages are a great jumping-off point to setting up your budget with how much you should pay every month.

Dave Ramsey’s Budget Percentage Recommendations:

- Charitable Gifts 10–15%

- Saving or Debt Repayment 10–15%

- Housing 25%

- Utilities 5–10%

- Food 5–15%

- Transportation 10%

- Clothing 2–7%

- Medical/Health 5–10%

- Insurance 10–25%

- Personal 5–10%

- Recreation 5–10%

Giving

Dave Ramsey really promotes a giving budget. Whether it’s through tithing, donations, or supporting certain causes– giving. This tends to be a bit of a controversial budget category for some people, but whether you decided to partake of this particular category or not, he recommends spending 10-15% of your total net income.

Savings or Debt Payments

There are a few reasons to save money: retirement, wealth building, covering emergencies, and irregular expenses a la Sinking Funds.

The other side of this coin is getting aggressive with paying down debt to work towards becoming debt free.

The first step in Dave Ramsey’s baby steps is building a $1,000 Emergency Fund before getting down to the business of wrecking your debt.

Ditching your high-interest debt and student loan ASAP.

If you have no debt you will need to build your Emergency Fund up to cover 3-6 months of expenses.

Once you’ve covered your full Emergency Fund, you get to move on to the wealth building.

How much should you be saving?

10-15% is the recommendation, but depending on your goals, that may look a little different.

One of my absolute favorite posts is from Mr. Money Mustache and his article about retiring early and the surprisingly simple math on how to do it. Super motivating!

Food

A family’s food budget is oftentimes the area in your budget where things start to veer off course.

Eating out gets expensive; quick coffees, and vending machine snacks all add up rather quickly.

But that’s not usually the whole story when it comes to spending on food, it can also be multi-week trips to the grocery store. Usually this budget challenge can be overcome with a little strategy in the way of meal planning.

Dave recommends 5-15% of your budget goes to food. Cost of living, dietary restrictions, etc. should all be considered when coming up with where you should be on this spectrum for spending.

Eating in or eating out it doesn’t matter as long as it’s accounted for in this budget line.

Utilities

Utilities are things like your electricity, water, trash services, sewer, cell phones and cable/internet. Dave recommends 5–10% for all monthly utilities.

Housing

How much should I spend on rent or mortgage? What kind of monthly payment can I afford?

Mortgage payments or rent are typically the biggest expense in a budget.

Dave says, no more than 25% of your take-home pay

The housing costs covers your rent or mortgage payment plus property taxes, HOA fees and PMI.

There are a few websites like Mortgage Calculator that make it super easy for you to see what you can actually afford. Just remember to include ALL housing expenses and to keep it below 25%.

I live in a very high cost of living area, and we chose to live well below the 25% benchmark as it was an easy way to give us more wiggle room in our budget.

Yes, we sacrificed a bigger place, and our children are sharing rooms, but it’s alleviated the stress of taking us to the ceiling of our budget!

Transportation

Transportation costs should account for 10% of your monthly income. Transportation covers car payments, registration fees, maintenance, repairs, and gasoline. Depending on where you live this could also include train, bus or subway fare, as well as parking.

Clothing

The recommendation for a clothing budget is 2-7%. While clothing is a necessity, that doesn’t necessarily mean it has to be expensive! Check out my list of over 100 money saving tips— clothing included— for ideas on how to save yourself more money!

Health

Dave recommends allocating 5–10% of your budget to health expenses. Health insurance, medications, co-pays, all fall here. Depending on what life throws at you, this is one category that could see quite a bit of month to month fluctuations.

In the event that there is a significant health event, starting a sinking fund for medical expenses could be a great way to offset the uncertainty of health care expenses.

Insurance

There is absolutely nothing sexy about insurance. It feels about as satisfying as buying socks. However, it is an absolute must! The recommendation here is to keep spending here between 10-25%.

Auto insurance. There are a few states that don’t require auto insurance, but most do. Help protect yourself and your assets with auto insurance.

Homeowner’s & renter’s insurance. All of your worldly possessions- together, under one roof. It’s a great idea to give one of the most significant parts of your life, that layer of protection– just in case.

Life Insurance. Benjamin Franklin said there are only 2 certainties in life: death and taxes.

Life insurance is a financial protection policy for your family that gives them a tax-free cash payment if you die while the policy is in effect. This can cover funeral expenses, outstanding debts, or help to support your family.

Recreation

Dave recommends 5–10% of your budget here.

Going to the movies, buying books, and vacations– this is the category for those types of expenses.

DON’T MISS IT!

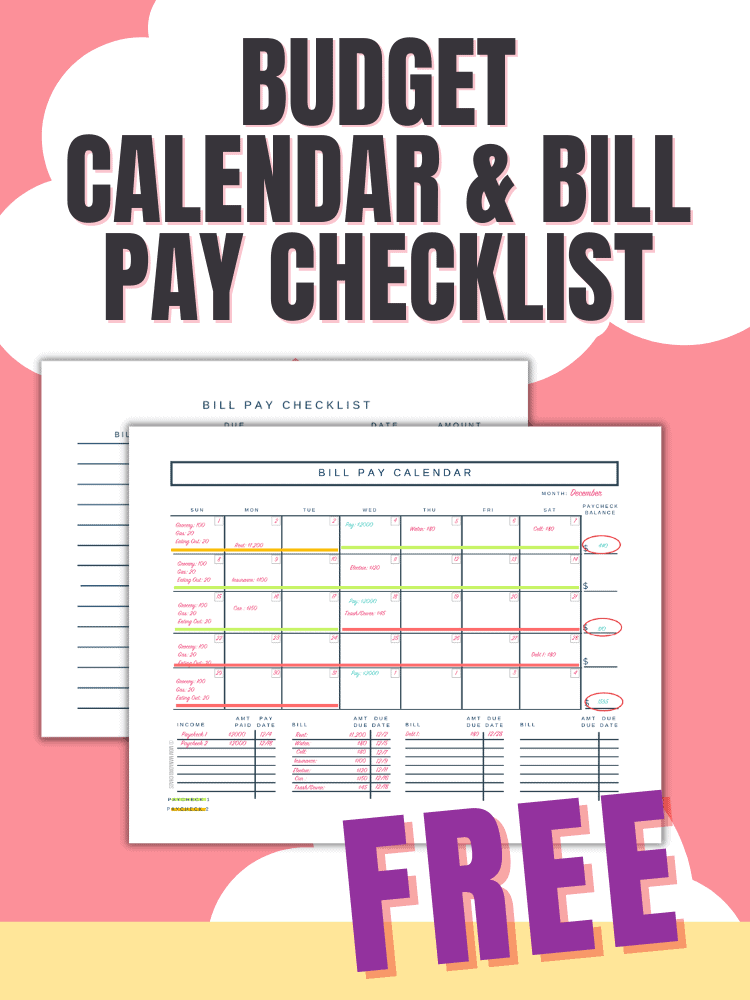

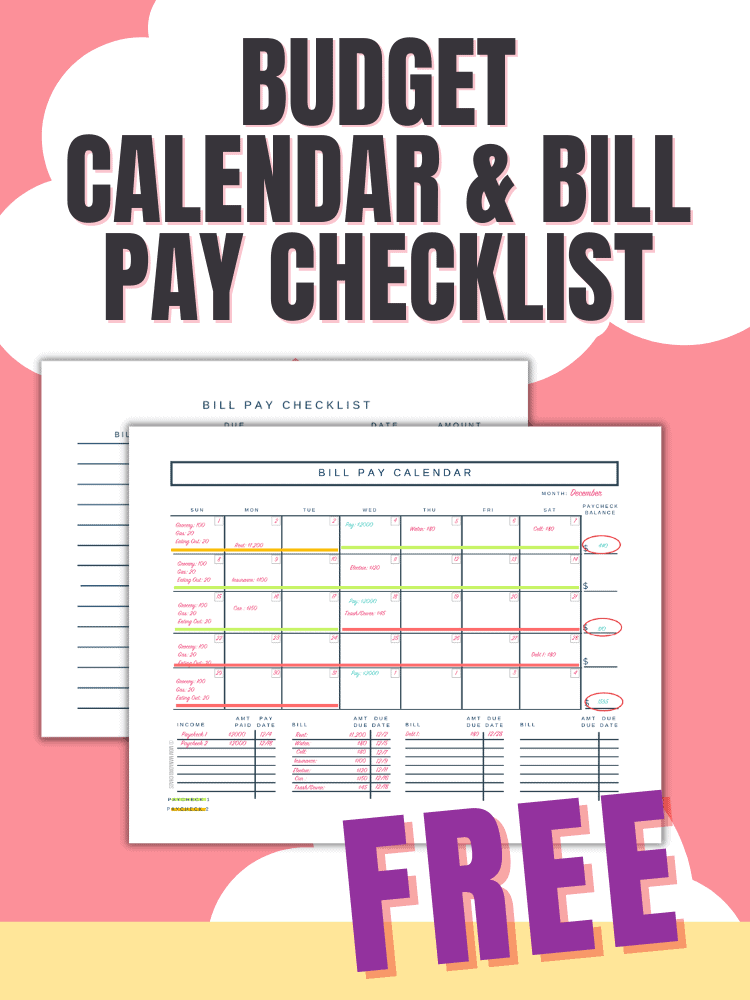

Drop your email address below to grab your free Budgeting Calendar and join a community of 36K other busy budgeters!

By entering your email address, you are agreeing to our Privacy Policy and European users agree to the data transfer policy.

Personal Spending

The recommendation here is between 5-10%.

Child Care, tuition, hair cuts, fun money. All happening here.

You are obsessed with Chip and Joanna and need ALL THE THINGS from Magnolia Market (Preach!). This is where the money for your fall-scented candle or those super cute votives comes from.

Want a new handbag or shoes? You want all the things from the Container Store (#nojudgements)– this is where you make it raaaaiiiinnnn!

I’m a big believer in this spending category. While you do need to prioritise spending and have a financial plan in place. Budgeting is kinda like dieting, you are going to have a hard time with sticking to the diet without that cheat day to give you some much need relief from your cauliflower pizza crust.

So, personal spending. Don’t be in a huge rush to cut this back.

I find I’m far more likely to overspend when I don’t get this little bit of fun money. Might as well give over to the controlled burn so things aren’t blazing outta control. Ya know?!

Dave Ramsey Example Budget

So what does this all look like in practice?

Let’s look at a family with a take home pay of $30,000. Check out this budget pie chart to take see what your spending would look like.

And now with the amounts budgeted based on the percentages (sample):

As you can see based on the pie chart and the budget snapshot, these give you a solid idea of what your budget could look like based on your income.

If you are looking for an easy way to organize you money and budgeting process, check out the Budgeting Bill Pay Calendar!

If you are more interested in the Dave Ramsey Budget Forms and Worksheets, he has them earmarked on his site.

Now for a super important follow up question– are these percentages right for you?

How to Budget Your Money with Budget Percentages that work for you

While Dave’s recommended budget percentages are a great jumping off point– a monthly budget is a very individualized piece of your financial picture.

For example, maybe you have spousal support or child care to factor in. Perhaps child care costs in your area are crazy high.

I remember when we lived in New England, sending our daughter to preschool was going to cost as much as our rent. Which is insane!

In case the suspense is killing you, I found Homeschool curriculum and worked with her an hour or so a day on my own and joined a bunch of play groups. Frugal me just couldn’t justify that much money for my then 4 year old. Nope!

The best way to start out when you are learning how to budget would be to start with your regular bills– more specifically your fixed expenses (rent/mortgage payment, tuition, etc.) and start planning out from there.

If your rent is eating up more than 25% of your budget, you are going to have to shrink some other areas to compensate.

An easy way to determine what you can expect for certain budgeting categories is to evaluate your spending by looking at the last 3-4 months spending to see where your money has been going.

Some banks offer this as a built in feature, but if yours doesn’t there are tons of budgeting apps and software that can do the same thing. I personally use Mint and love it. I tried You Need A Budget, but it just didn’t work for me, but I know tons of people who love it.

Dave Ramsey also now offers EveryDollar budget app. The app comes with both a free version and a paid version. The basis of the app follows Dave’s budgeting methodology of zero based budget.

DON’T MISS IT!

Drop your email address below to grab your free Budgeting Calendar and join a community of 36K other busy budgeters!

By entering your email address, you are agreeing to our Privacy Policy and European users agree to the data transfer policy.

What Else to include in a budget?

Another important consideration when building your monthly budget is to take into account your money goals.

Are you saving for a down payment on a house? Trying to pay down debt? Need a vacation?

Incorporating these goals is an important step to stop you from accumulating more debt (throwing it all on a credit card) or just moving you toward achieving those goals.

Experience has shown me, that I’ve been far more successful when I have a specific plan for every dollar rather than just throwing a lump sum in my savings and then calling it good.

How do you know if what you are contributing is enough? Are you stealing from your down payment fund to pay for that vacation? It’s important to earmark money as specifically as possible.

Related Money Saving Posts:

125 Practical Ways to Start Saving Money, Today!

Rock Your Grocery Budget Every Month

How to Stop Spending Money | Become a More Mindful Spender