Are you a sinking fund beginner? Do you find yourself wondering things like, What is a sinking fund? Are there different sinking fund categories?

Then this article is for you!

There seems to be some confusion around what a sinking fund is and isn’t, as well as why they are so important.

What if I told you sinking funds are a not so secret tool you can use to make sticking to your budget easier and help you reach financial goals.

Sounds great, right?

Let’s talk about sinking fund strategies for beginners and why this tool is a critical piece in taking your money management skills to boss level status.

DON’T MISS IT!

Drop your email address below to grab your free Budgeting Calendar and join a community of 36K other busy budgeters!

By entering your email address, you are agreeing to our Privacy Policy and European users agree to the data transfer policy.

Table of Contents

What is a Sinking Fund?

A sinking fund is simply a strategic way that a person (or family) can save money by setting a little bit aside every month.

Each sinking fund is earmarked for a unique and specific purpose.

These funds are a critical piece of any budget as they add a layer of protection (and extra money) for future financial situations where the timing is either known or unknown.

How Do Sinking Funds Work?

So how do sinking funds work? Sinking funds work by every month, saving a little bit of money across several budget categories to be used at some point in the future.

What’s the difference between a sinking fund and a savings account?

You might be wondering why are sinking funds important and why you can’t just throw money into a savings account and call it good.

Let’s look at some sinking fund examples:

Let’s assume that you put $500 away into a savings account every month for a total of $6000 at the end of the year.

Feels good, right? Having a stack of cash in the bank.

Let’s say it’s Christmas time and you decide you’ve been great all year and you want to take your family on vacation.

You take a holiday cruise and spend about $4,000 from your savings account.

Now, it’s New Years and your car’s transmission goes out. No problem, you’ve got $2,000 left in savings to cover that expense.

But then your furnace breaks and the repair is going to be expensive. Now you’re out of money. You emptied your savings account with your vacation and for your car repair.

Where does that leave you for covering furnace repair?

Let’s look at what this same situation would look like with some sinking fund examples, assuming the same $500/month savings:

- Car Repairs: $167/ month (Total for the year $2,004)

- Home Maintenance + repair: $167/month (Total for the year $2,004)

- Vacation: $166/ month (Total for the year $1,992)

Yes, there’s a big drop off in vacation spending, but that’s what you could actually afford to pay based on your savings.

Coming up with a sinking funds list helps to ensure that you have money available to cover these kinds of future expenses.

What Sinking funds should I have?

Now than you know what a sinking fund is and how they work, let’s talk about what sinking funds you should have in your budget.

Essential Sinking Funds

Essential sinking funds are funds that (for the majority if people) are more necessary savings goal than a nice-to-have savings goal.

Some essential sinking funds would be categories like:

Home

This funds covers expenses related to your home like adding a deck, landscaping, new appliances, servicing appliances, etc.

If your roof was damaged by a falling tree or your windows were knocked out in a storm– these types of expenses would be covered by your emergency fund (because they would indeed be an emergency).

Vehicle

This fund would cover expenses related to owning a vehicle like new tires, maintenance, any specific repairs you know your car will require.

Medical

This fnd would cover medical expenses like co-pays, prescriptions, insurance bills, long term specialty care, etc.

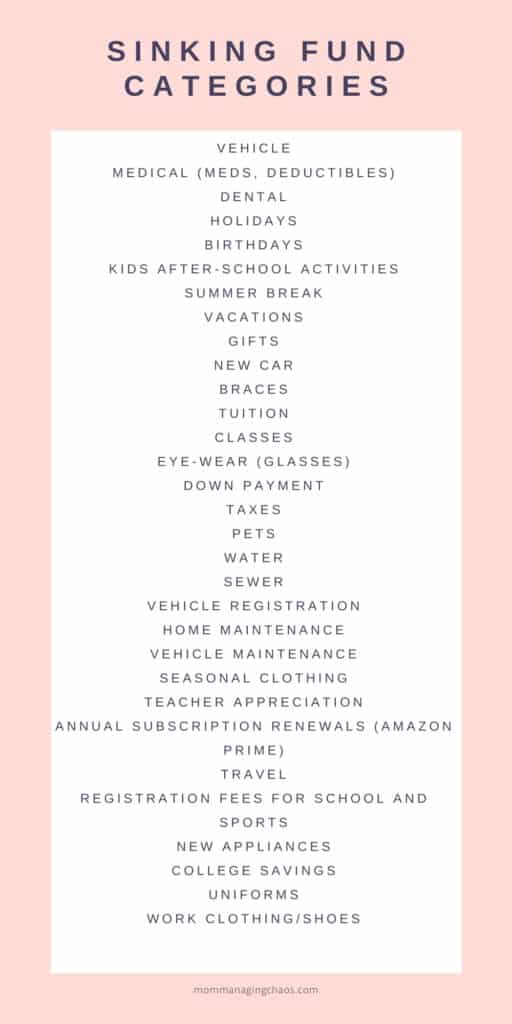

Other Sinking Fund List Ideas

Here’s a list of other sinking funds you might want to include in your monthly budget:

- Utilities (if your water bill, trash, etc occur quarterly instead of every month

- Holidays

- Birthdays

- Education (teacher appreciation, yearbook, pictures, field trips, etc.)

- Taxes

- HOAs

- Dental

- Eye Expenses (glasses, exams, contacts, etc)

- Child (clothing, shoes, activities)

- Personal Care (Hair cuts, manicure, pedicure, etc)

- Vacations

- New Vehicle

- Vet Care

- Renovations

- Special Occasions (weddings, anniversaries, etc.)

- Electronics (new computer, tablet, etc.)

How many sinking funds should I have?

There are limitless possibilities when it comes to sinking fund categories, but it would be prudent to start with your essential sinking funds and then filling out your list based on historically what you’ve needed as well as what you know is coming up.

If you are struggling to come up with your own personalized comprehensive list it might help to think of sinking funds as falling into one of two categories: expected expenses with a set dollar amount and unplanned expenses (known expenses but without a specific due date).

Expected expenses are just what they sound like, expenses that you know are coming, regardless of if you know when they will occur.

Expected expenses will be categories like:

- Back to school

- Holidays

- Birthdays

- New Vehicle

- Clothing

- Taxes

- KidsActivities

- Tuition

Unplanned expenses would be sinking fund categories like:

- Car repairs

- Home repairs

- High dollar value appliance repairs

- Medical Bills

If you are still struggling check out the list above as well as check through last years spending.

DON’T MISS IT!

Drop your email address below to grab your free Budgeting Calendar and join a community of 36K other busy budgeters!

By entering your email address, you are agreeing to our Privacy Policy and European users agree to the data transfer policy.

How to calculate how much should be in your sinking funds

There are two key components to consider when you calculate how much should be in your sinking funds. How long until you need the money available, and how much money you have to allocate toward savings.

Here’s how to calculate how much should be in a sinking fund:

Step #1: List out all your sinking fund categories.

Step #2: Come up with a timeline of when these sinking fund categories will be needed.

Step #3: Calculate how much money you have every month to put towards your savings.

Step #4: Prioritize how you will fund your sinking funds if you don’t have enough money to save for all of them concurrently.

Step #5: Take the amount you need to save for each sinking fund and divide by the number of months you have to save to determine how much money you need to save each month.

How to set up and organize your sinking funds

Keeping your sinking funds organized (especially when you have many!) is key, and you have a few options when it comes to organizing them all.

Option 1: Keep all your money together in the same savings account.

If you want to keep the number of accounts down to a minimum this is certainly an option, but be sure to track each fund individually.

Option 2: Open a savings account for each sinking fund.

There are tons of banks (both online and brick & mortar) that offer free savings accounts. This makes tracking the balances of your funds super easy, but it is alot of accounts you’ll need to open.

Option 3:: Use cash envelopes to save for sinking funds.

Cash envelopes are nice because it makes it harder for you to ‘accidentally’ spend money you needed for savings– you’d literally have to go into each envelope and take the money away.

It also makes tracking easy as you can physically count out your cash.

The downside to this method is that you would need to go and get the cash out every time you wanted to add to the fund.

Option 4: Choose a bank with the ability to keep one account but allocate them money with different labels.

This option is a hybrid of option 1 and 2 if you find a bank that offers this service. One bank that I know offers this option is Ally bank.

The Best Accounts Options to Keep your Sinking Funds

Now that you’ve done all the hard work of planning and organizing for your sinking funds, let’s talk about where the best options for setting up a sinking fund.

Cash envelopes.

Many families find great success with cash budgeting and prefer this method over transferring money or making tons of small deposits. The risk here being that if something happens to that envelope (it gets lost or damaged) that’s the end of that sinking fund.

Regular savings account.

This is probably one of the most common options. It’s easy, accessible and makes transfers simple.

High Yield Savings account

These accounts are similar to regular savings accounts but offer a higher interest rate than regular savings account.

Certificates of Deposit

You essentially purchase a certificate with a guaranteed interest rate for a fixed period of time. The downside to this is that since you have to commit to a certain period of time you can’t withdrawal your money until that date. Not making it ideal for any sinking funds with an uncertain date of when you’d need it or funds you’ll need relatively quickly.

What’s the difference between a sinking fund and an emergency fund?

Sinking funds and an emergency fund may feel similar they serve two distinctly different purposes.The primary difference bing the savings goal.

With an emergency fund, you start saving money with the intent to give yourself a cushion of cash should an emergency arise at some point in the future like job loss, medical emergencies, etc.

When you create a sinking fund you are putting money for known future expenses (whether you know the specific date you’ll need it or not).

How to Track savings with a sinking fund printable tracker

Tracking sinking funds doesn’t have to be complicated.

Whether you set up a spreadsheet, write it down on a sheet of paper or utilize a printable– they are all good options.

The important part is to make sure you are tracking each sinking fund and that you are consistent.

If you want an easy made for you sinking fund tracker printable, you can grab the one below.

DON’T MISS IT!

Drop your email address below to grab your free Budgeting Calendar and join a community of 36K other busy budgeters!

By entering your email address, you are agreeing to our Privacy Policy and European users agree to the data transfer policy.

Where Does the Money for Sinking Funds Come From?

First, check your budget and see what you can start putting aside for your sinking funds. Even if it’s only a few dollars here and there at first, something is most definitely better than nothing.

The point of these funds is to look ahead at bills you KNOW are coming due. So ready or not, you are going to have to pay for it. Give yourself the peace of mind to have the money ready or a plan in place to get ready for these upcoming expenses.

The second part of funding these accounts is deciding what gets paid first.

Based on the list you made previously of what you need to prepare for, I would start with the most immediate needs first.

Is your annual home winterization about to come due? Is it time to enroll your child in Fall Ball? What about Property Taxes?

Whatever you are setting money aside for, prioritize where the money needs to go first. Once you have those accounts fully funded, move on to the next need.

What Happens if You Don’t Have Enough to Fund Everything?

Let’s say you go line by line through your list and due dates and have the monthly totals you need to be saving.

Trouble is you don’t have enough money yet to fully fund everything. What do you do?

Start with the most important and work your way down.

Once you get one category fully funded, roll that money over into something else until you have everything covered.

If you are in the early stages and something crops up sooner than expected one option would be to borrow from other funds.

Another possibility to consider is picking up a side hustle! There are tons of ways you can earn a few extra bucks:

- Selling unused stuff either with garage sales or Facebook Marketplace.

- Sign up for surveys to make a little extra cash or earn gift cards. One of my favorites is Swagbucks, but there are lots of good options.

- Babysitting

- ThredUp.Think of ThredUp as an online consignment shop. The reason I am in love with this website is that, not only am I getting a great deal on gently used, or never worn items are available for great prices, but they also will accept your clothes. They will send you what they call their “Clean Out bag”. It gets processed (they go through everything) and then they’ll send you an email with your earnings. The first 14 days, you can use your credit to purchase items from the thredUP.com. After 14 days, you can cash out using PayPal or a thredUP Visa Prepaid Card. I’m kind of obsessed with this website. Bonus! If you sign up through my link above you get a $10 credit.

DON’T MISS IT!

Drop your email address below to grab your free Budgeting Calendar and join a community of 36K other busy budgeters!

By entering your email address, you are agreeing to our Privacy Policy and European users agree to the data transfer policy.

The Take-Away

Sinking Funds serve a strong purpose as a part of your overall budget. They can help keep you from racking up additional debt. They can ease the burden of the irregular and unexpected expenses, but you have to do your part by being prepared and regularly contributing to them, even if it’s just a few dollars here and there.

If you are looking for ways to find extra money to start building your sinking funds fast, I’ve got a fantastic round-up of some great, easy side hustle ideas, which I talked about in my post about how to build an Emergency Fund.

Thank you for the AWESOME article!! I really had no idea about Sinking Funds other than the definition and now I feel ready to tackle that part of my budget. Before now I’ve just been “borrowing” the money from the monthly budget when something comes up, until I had extensive auto maintenance $4,000! Needless to say this left me scrambling in all directions!!

Hi!

Thank you so much for the kind words. I’m happy to hear you found it helpful.

Yes, sinking funds are such a solid way to help keep your budget on track. Depending on monthly expenses, some families are able to borrow to make up for the unexpected expenses, but as you mentioned, it only takes one big financial incident to really show you where sinking funds can help. I think you’ll find you stress less once you get these sinking funds set up and funded.

Cheers,

Kristen