Let’s cut through the noise and get real about money. With everything and everyone being online now, it can be hard to separate fact from fiction. But fear not, because we’re here to set the record straight.

From debunking misconceptions about debt to talking about planning for your future. Let’s jump into some of the more popular money myths floating around!

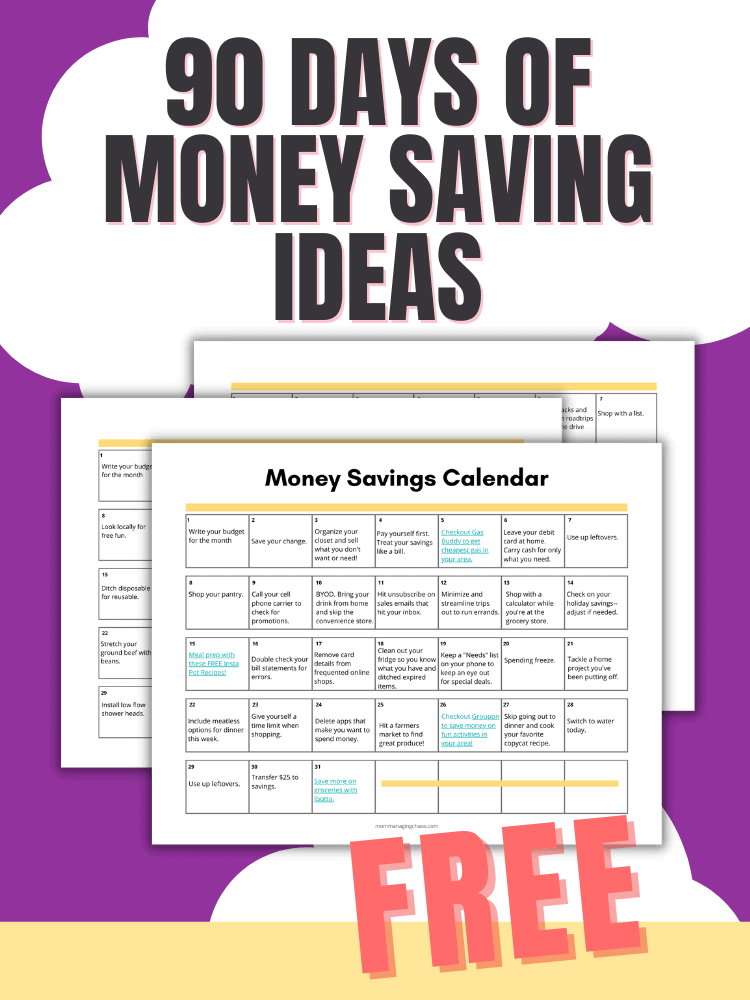

Don’t Miss This Chance!

Drop your email address below to grab 3 months of money-saving ideas and join a community of 22K other savvy savers!

By entering your email address, you are agreeing to our Privacy Policy and European users agree to the data transfer policy.

Table of Contents

Budgeting is Restrictive

When people think about the word “budget”, it generally comes with feelings of being restricted or deprived. When in reality, this couldn’t be further from the truth.

Budgeting isn’t about depriving yourself, it’s about making the best use of what you have. It allows you to prioritize your priorities.

For example, if being able to enjoy a nice meal out is important to you, you get to prioritize that. Does that mean you have unlimited funds to make that happen? No. But you do get to decide how to make that happen.

Maybe that means you skip more expensive entertainment options or you go with a lower cell phone plan. But you are in the driver’s seat.

You are in charge of your money. It’s not in charge of you.

I Can Always Save Later

It’s easy to think, “I can always save later,” but this mindset often leads to missed opportunities and potential issues later.

By delaying your savings, you’re forfeiting the magic of compound interest, which has the power to transform modest savings into significant wealth over time.

This isn’t just about socking away money; it’s about building a habit that secures financial freedom and prepares you for retirement.

The earlier you start, the more you’ll thank yourself down the road.

I Don’t Need Emergency Savings

You may have found yourself thinking: “I don’t need emergency savings; I’ll figure it out.”

While it may feel easier now, to figure it out later – this is almost a guaranteed recipe for unnecessary stress and a potential pile of new debt.

Imagine for a moment your car breaks down, or a sudden medical expense crops up. Without an emergency fund, these situations turn from inconvenient to really-bad-day really quick. If you don’t have cash on hand to manage these — high interest debt os often the only option.

Building an emergency savings account isn’t just a safety net—it’s your first line of defense in maintaining financial stability and peace of mind.

By prioritizing this aspect of financial planning, you help shield yourself from the unpredictability of life, ensuring that when, not if, those unexpected expenses occur, you’re prepared, not panicked.

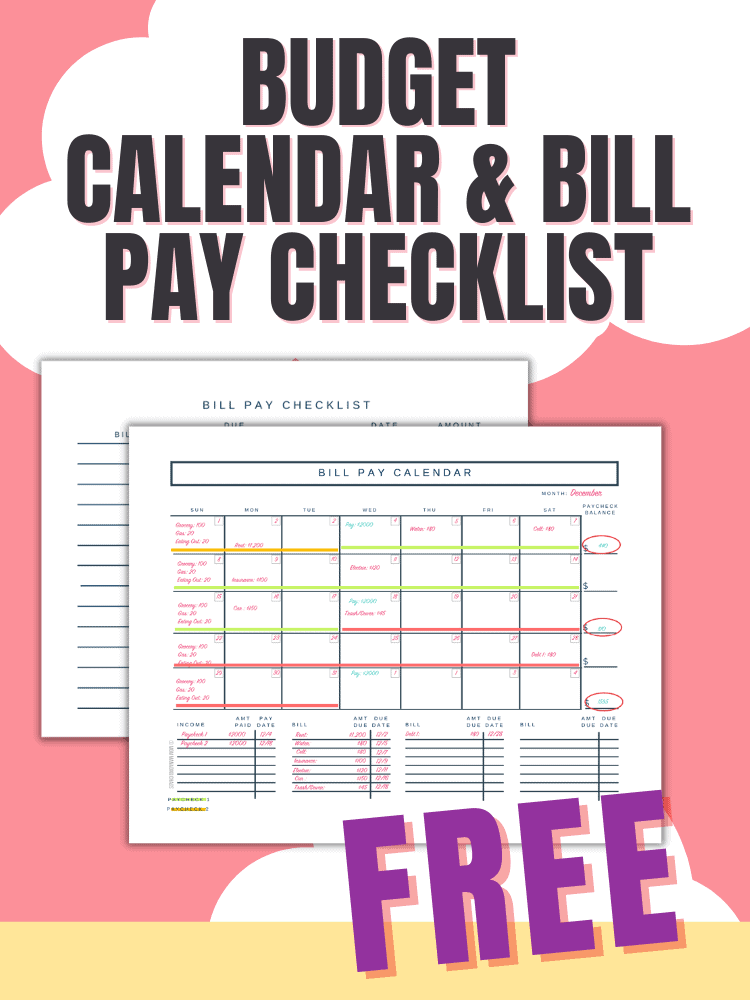

DON’T MISS IT!

Drop your email address below to grab your free Budgeting Calendar and join a community of 36K other busy budgeters!

By entering your email address, you are agreeing to our Privacy Policy and European users agree to the data transfer policy.

Fancy Math is gonna fix your problems

When you are trying to get your money in order, it can be easy to whip out your trusty calculator or spreadsheet and start throwing out lots of numbers.

And knowing your numbers is important, no denying that– but most times, it wasn’t poor math that got you into your money situation, so it’s going to take more than just math to get you out of it.

Taking a look at the cause of your current money issues is as important a step as knowing how far you have to go to reach your goals.

If you are someone who often overspends or relies on debt to cover irregular expenses, a spreadsheet and fancy math isn’t the only thing that’ll be needed to get your money situation under control and headed in a positive direction.

I’ll Always Be Broke

Feeling like you’ll always be broke is more common than you might think. Financial downturns have led many of us to believe that climbing out of that pit is a dream too far out of reach.

Yet, many families have turned their money situation around, becoming adept at saving money, mastering debt management, and even delving into the world of investing.

Consider the power of an emergency savings fund. It was the first step for many in breaking free from the paycheck-to-paycheck cycle.

Then, tackling credit card balances with smart debt management strategies proved transformative. Imagine finding freedom by deciding that financial planning isn’t just for the well-off but for anyone determined to build wealth.

By realizing that you’re never too old or too broke to start, the journey toward financial freedom transforms from a hope to an actionable plan.