If you are new to budgeting, it can feel overwhelming coming up with a plan and making decisions about where your money needs to go.

If this is not your first budgeting rodeo– perhaps you are still struggling with finding the right budgeting method that works for you!

Are you looking for a simpler approach to budgeting? Harvard bankruptcy expert and U.S. Senator from Massachusetts, Elizabeth Warren may be the answer you have been searching for– the 50/30/20 budget!

The 50/30/20 Budget Explained

What are the rules of 50/30/20 budgeting?

This budgeting method breaks up your after-tax income into 3 different categories. Each category is assigned a budget percentage of your income. You allot 50% of your after tax income to Needs, 30% to Wants and the remaining 20% is used for Savings or Debt repayments.

How to Calculate Your Take Home Pay (or Your After Tax Income)

After-tax income is what is left of your paycheck after state tax, local tax, income tax, Social Security, and Medicare are taken out.

If you have health care, 401 K contributions or any other automatic deductions taken out of your paycheck, you’ll need to add those back into your after-tax income.

What is the 50/30/20 Budget Strategy?

The strategy behind this budget method is to create a simple, easy to follow budget by giving you very easy to understand left and right limits without having to get down into the weeds of the details or having to track a bunch of different categories.

Who Does the 50/30/20 Budget Work for?

Whenever you are making changes to your managing your money, it’s helpful to compare the benefits with the potential pitfalls. Let’s take a look at the pros of working with this budget.

- Great for beginning budgeters. If you have no idea what a budget looks or acts like, this is a great starting point on your financial journey.

- Includes fun money!

- Easily adaptable. Whether you have a fixed income or a more fluid income source, both can be budgeted easily with this method.

- Provides well-balanced budget parameters.

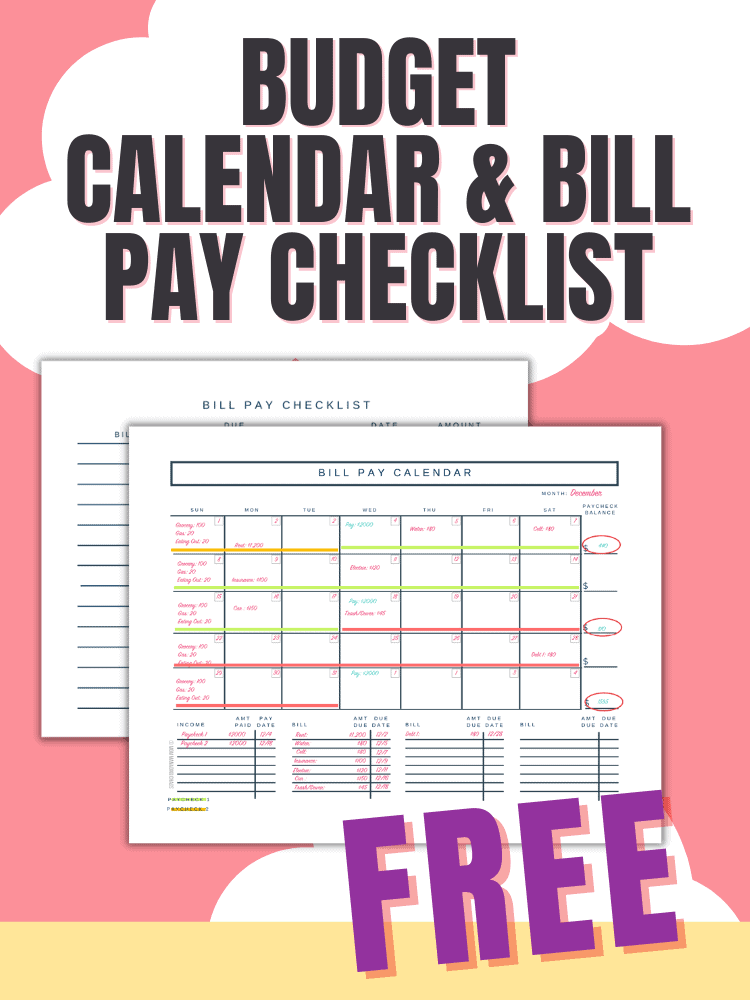

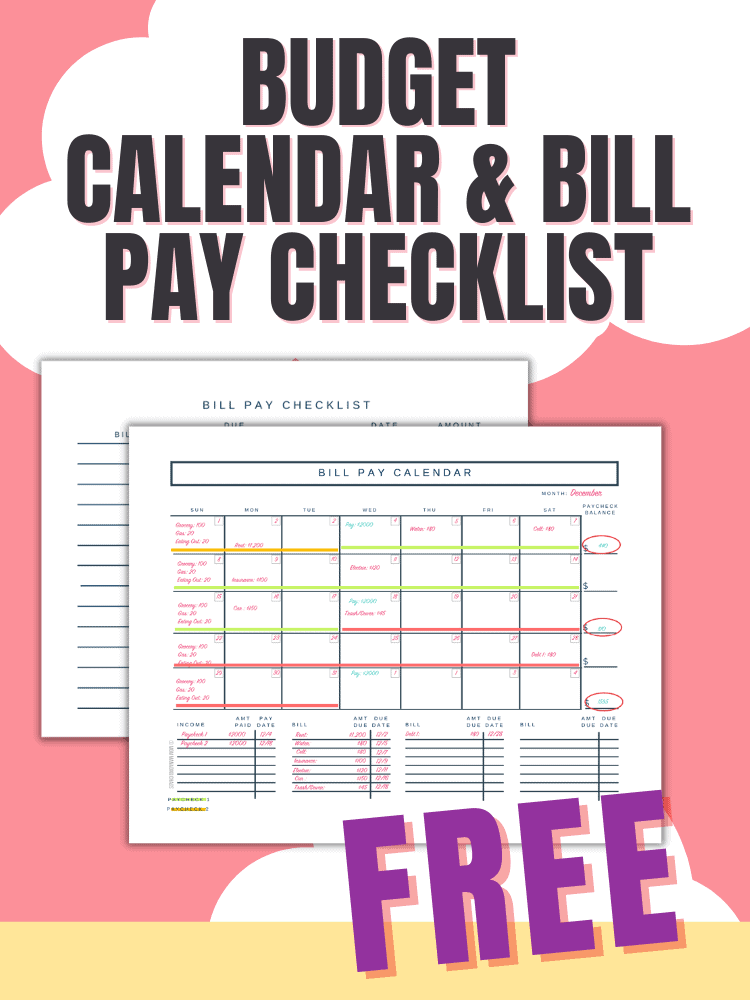

DON’T MISS IT!

Drop your email address below to grab your free Budgeting Calendar and join a community of 36K other busy budgeters!

By entering your email address, you are agreeing to our Privacy Policy and European users agree to the data transfer policy.

What are some potential issues with the 50/30/20 Budget?

- Doesn’t work well for extremely tight budgets. Perhaps your take-home pay doesn’t allow for 30% of “wants” or even 20% to savings or debts.

- Since you aren’t really tracking across specific categories, this budgeting method has the potential to mask some serious spending issues.

- When you are moving into higher income brackets, this budget has the potential to bring spending to unreasonable levels. If you are making $100,000 year, that put’s your living expenses at around $4,100/month. Remember this is after tax dollars. Depending on the cost of living in your area, but that seems like an awful lot of money to be spending on rent, groceries, etc.

- Not a good option for people serious about debt repayment. Due to only contributing 20% of your income to debt, it could really stretch out the amount of time it would take you to work into getting debt free!

How Does the 50/30/20 Work?

Category 1: 50% for Needs

Half of your after-tax income goes to your basic needs. Needs are things you have to pay no matter where you live, work, etc. and need for your absolute existence.

Budget categories for needs would look something like this:

- Shelter (rent or mortgage)

- Food (groceries)

- Utilities

- Debt Minimum Payments

- Transportation to work (car, bus, taxi, train, fuel, maintenance, etc.)

Category 2: 30% for Wants

Thirty percent of your after-tax income goes to things you want. Budget categories for wants could look something like this:

- Dining Out

- Cell Phone

- Cable + Internet

- Clothing

- Gym Membership

- Starbucks

- Entertainment (Movies, books, music)

- Personal care (haircuts, pedicures, etc)

- Art Classes

Category 3: 20% for Savings and Debt

How much should you be saving per paycheck?? According to this method, twenty percent of your after-tax income goes toward savings or paying down debt. Budgeting categories for savings and debts could look something like this:

- 401 K Contributions

- Emergency Fund

- Sinking Fund

- Extra Debt Payments

DON’T MISS IT!

Drop your email address below to grab your free Budgeting Calendar and join a community of 36K other busy budgeters!

By entering your email address, you are agreeing to our Privacy Policy and European users agree to the data transfer policy.

50/30/20 Budget Example

Now that we know the strategy behind this budget, the rules and how it works, let’s jump into an example.

Assuming, for our example, an after-tax income of $3000 a month.

Needs Budget

$3000/ 50% = $1500 a month.

- Shelter (rent or mortgage): $900

- Food (groceries): $300

- Utilities: $100

- Debt (Minimum Payments): $50

- Transportation to work (car, bus, taxi, train, fuel, maintenance, etc.): $150

Wants Budget

$3000/ 30% = $900 a month.

- Dining Out: $200

- Cell Phone: $80

- Cable + Internet: $80

- Clothing: $50

- Gym Membership: $80

- Starbucks: $40

- Entertainment (Movies, books, music) $150

- Personal care (haircuts, pedicures, etc): $100

- Art Classes: $120

Savings and Debt Category

$3000/ 20% = $600 a month.

- 401 K Contributions: $300

- Emergency Fund: $100

- Sinking Fund: $50

- Extra Debt Payments: $150

Related Budgeting Posts:

- The Cash Envelope System | Everything You Need to Know

- Zero Based Budget | Putting Yourself in Control of Your Finances