You know what’s hard? Parting with part (or all) of your income every month.

Bills are an unfortunate fact of life. Whether you are paying down a mortgage, your internet bill, a cell phone– you have expenses that you need to pay every month and you need an organized way to keep track of them all and your payments.

Late payments can come with penalties, late fees can be anywhere from $25-$100 per occurrence and you can damage your credit rating. So paying on time is essential for your financial health!

Plus, if you aren’t tracking what payments are being processed and when you have the potential to overdraft your bank account and access yet another fee.

So, how can you avoid those pesky fees? How can you keep track of all your bills and payments? What is the best way to pay bills each month?

Let’s take a look.

This post may have affiliate links, which means I may receive commissions if you choose to purchase through links I provide (at no extra cost to you). Please see my full disclosure policy for details.

Table of Contents

An Easy Way to pay your bills

If you are like most people you have a checking account and a savings account. But, have you ever considered that there may be an easier way to organize your money?

One of the easiest ways to make sure you are staying on budget and not overspending your budget is opening more than one checking account.

We have 3 checking accounts:

1.Checking Account #1- Strictly for Bills

2.Checking Account #2- Spouse 1’s variable expenses and spending

3.Checking Account #3- Spouse 2’s variable expenses and spending

When you keep a separate pot of money for your bills you are ensuring you are not spending money that you need for bills– which is a chief problem many people run into.

The second benefit to this multi-checking account system is that each spouse has their own account to cover expenses that they are responsible for so that neither person is overdrawing an account.

Choosing Your Payment Method

1.Auto Bill Pay.

Signing up for auto-bill pay can be one of the easiest ways to make sure your bills are paid on time. Plus, some companies will offer you a discount for electing to pay automatically.

The potential problem with automatic bill pay is that if you aren’t diligent with tracking your money, you may forget about when and how much money is coming out, especially if it’s a variable bill.

2.Paying Online with Bill Pay

I love the online bill pay option for the bills I can’t pay automatically. First, you can schedule everything at once and set it for whatever date you want in the future. Second, no need for those pesky envelopes and stamps. Lastly, because you are paying electronically, you have a receipt for your records.

3. Other Payment Methods

Pay by mail: If you have the company’s payment address, you can also submit a check for the amount due.

Participating Stores: Stores like Walmart, CVS, Kroger, etc. can also accept bill payments — vendor dependent.

DON’T MISS IT!

Drop your email address below to grab your free Budgeting Calendar and join a community of 36K other busy budgeters!

By entering your email address, you are agreeing to our Privacy Policy and European users agree to the data transfer policy.

Don’t Forget to Account for Irregular Bills

Not all bills occur every month.

Don’t forget to include bills that happen quarterly (like taxes), yearly (like property tax or auto safety inspections), etc.

Sinking funds are a great way to track and put money aside for these kinds of expenses.

With the Calendar Bill payment method you can print out each month’s calendar for the year and mark the irregular expenses at the beginning of the year (or as you learn about them) to ensure that you aren’t missing anything.

How to Keep Track of Your Bills

When you are reconciling your budget, make sure to mark bills that have cleared your account. On the monthly bill tracker template below, there is a column with a check mark at the top– that is the column dedicated to making sure the payment wasn’t just marked to be paid, but also cleared your account.

You need to not only track what bills are due and how much you paid, but then you also need to take a look and see if there is anything pending so you know how much money you really have available.

INCLUDE Periodic Price Reviews

Internet, cell service, insurance, etc. are expenses where you can save money by taking advantage of promotions or simply by calling and having them price match their competitor. Just because something cost a certain amount when you signed up for it, doesn’t mean you have to keep paying that price forever and ever.

Checking prices once a quarter would be something you should add into your budgeting meetings.

Why pay more, when you can pay less?!

How to Keep Track of Bills and Payments

Step 1: Have a Specific Spot for Your Bills.

Whether you are getting bills through the mail, through your email, or you have to sign in every month to check– you need to have one place for them all.

Organizing Paper Bills

I have this bill organizer from Amazon and it is ahhhhmazing!

It has slots for each day of the month so you can file your paper bills as they come in by due date. And it has a small drawer underneath so you can keep your checkbook, highlighters, paperclips, stamps, envelopes–anything you need to sit down and pay bills every month.

Organizing Online Bills

Online bills are super easy to get missed if you don’t have a good system in place.

One of my favorite ways to handle bills that you receive via email is by setting up a specific folder just for them inside your email account.

In my email account, I set up folders by year, followed by sub-folders with the corresponding months. It keeps my bills organized and it also provides a historical record in case I ever need to go back and check something.

Step 2: Dedicate a time and place to paying bills every month.

What do you do when you open your bills? Are you dropping them onto a table? Do you have a home office? Are you paying your bills at your dining room table?

It doesn’t matter where you decide to pay your bills every month, but staying consistent and organized will go a long way towards making sure you stay on track and aren’t having to hunt around for everything you need.

Once you’ve figured out where you want to pay bills, you need to decided how often you should be paying bills.

How often should you pay bills?

- Weekly budgeting. Checking in every week can be great way to gain control over your money and keep your impulses in check and to make sure all your financial obligations are being met for the week (thus avoiding late or missed payments).

- Pay bills each pay period. Paying bills as your money comes in can be helpful for those individuals who are living paycheck to paycheck and need to be sure they are paying all their bills before spending it on non-necessity items.

- Pay bills once a month. Most bills are due once a month, so you may only want/need to sit down at the beginning of the month to pay everything.

Another option to make sure you pay bills on time would be to utilize automatic payments. With the popularity of online banking now, this is incredibly easy to set up.

Step 3: Make a list of all your bills, their due dates and the amounts owed.

Now that you have your bills organized, you know where and when you are going to be paying your bills–make a list of all your bills.

You want to write down everything you owe for the month, when they are due and how much you owe.

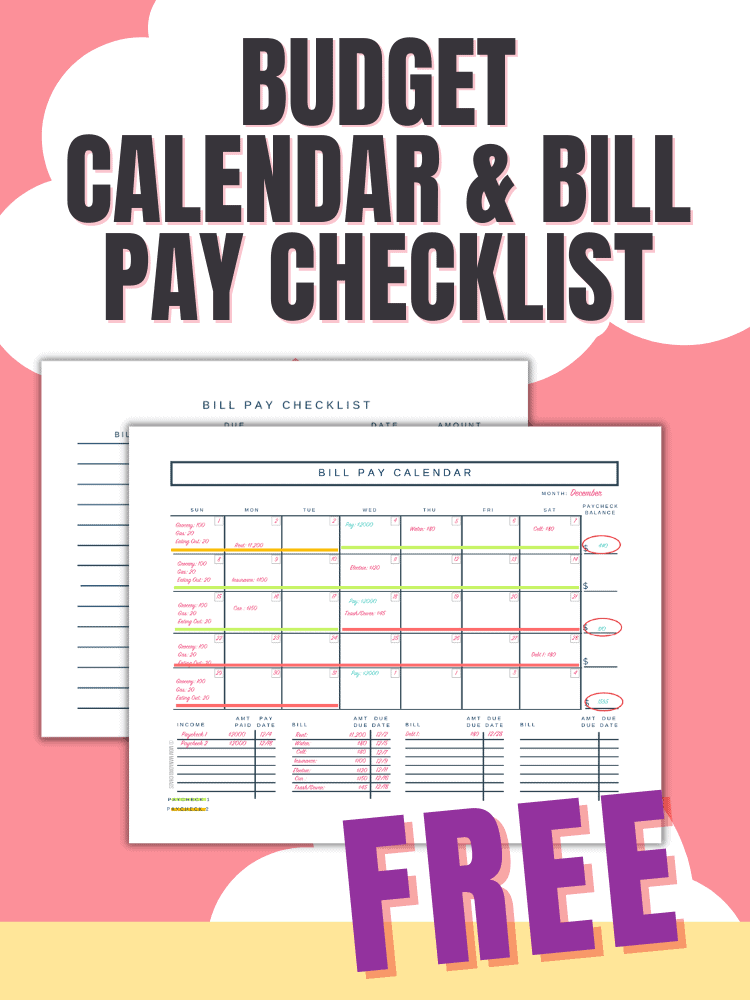

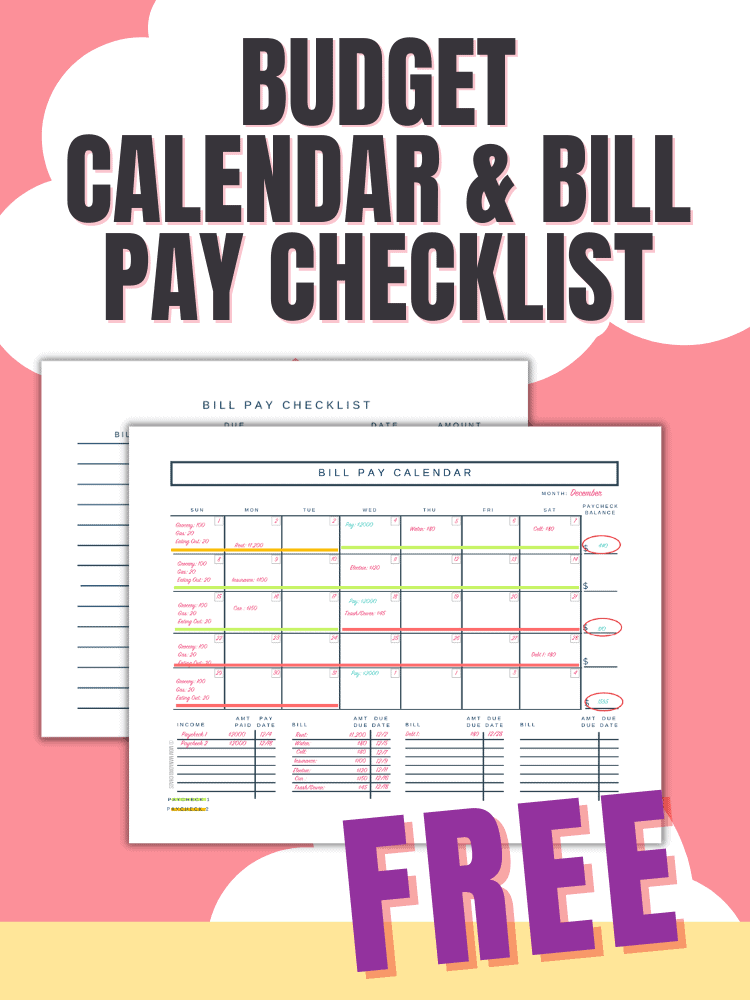

Step 4: Create a Bill Paying Calendar

The last step in this process is to put everything together: bills, income and due dates in one place.

Using a bill pay calendar gives you great visualization of your income, expenses and payment due dates.

I created this bill pay calendar (be sure to grab your Bill Pay Calendar template free from the Resource Library) so I can sort through all my bills and decide when each bill is due and when I need to pay it.

Once I’ve paid each bill, I simply highlight it on the calendar to mark it as paid. Between this calendar and my bill pay tracker, it would be virtually impossible for you to miss a bill.

Simple. Easy. Effective.

Step 5: Sign up for bill reminders.

Reminders for monthly payment due dates are a great safety net in case Murphy comes calling. If your biller doesn’t offer reminders, and you utilize Google Calendar for your Bill Pay calendar you can have email reminders sent to you, just to double check that you haven’t missed anything.

DON’T MISS IT!

Drop your email address below to grab your free Budgeting Calendar and join a community of 36K other busy budgeters!

By entering your email address, you are agreeing to our Privacy Policy and European users agree to the data transfer policy.

Step 6: Sign up for (free) Credit Monitoring service.

Life happens. Identity theft happens. Companies make mistakes when applying payment information. Getting ahead of these things by signing up to monitor your credit is just one more added layer of financial protection.

Credit Sesame offers you a free credit score every month as well as free credit monitoring and ID protection. Getting alerts about any problems that crop up as they crop up could be huge in helping you resolve these issues before they turn into bigger issues!

I’d love to hear from you, please comment below if you have any bill-paying tips or questions!

I have read thru all if your suggestions and I can’t wait to put them to use because I have really been struggling to make ends meet. Falling short on funds to pay bills and those extra bank fees that you mentioned. So thank you!

Thank you, Sandra for your reply. Wishing you all the best in the new year!

Wonderful you’ve saved my life ,I’m never on time with my bills and I end up with so much debt

I’m so glad you’ve found this helpful, Stephanie!

I’m excited to receive the email Bill Pay Calendar

We too have 3 checking accounts and we are finally out of the red!! 1 strictly for the TV charges and food spending. The other 2 checking accounts are for, mortgage, electricity etc. My husband gets paid every other week I get my money at the end of the month. It works for us! Had to call and change a few due dates. But since we started this process we are finally in the black hopefully to stay that way.

Hi Muriel! I love that you found something that works! I’ve really found (like you) that having separate accounts, really made the tracking and keeping our spending on track easier.

Thanks so much for commenting!

These are some very simple and straightforward ideas. Love your concise explanations. I actually had one of those organizers at one point and I think it got lost in a move. It was awesome!! I love the “ticker” idea of it. I was a teller and we used a ticker method. Thanks for sharing your bill calendar. I have had some trouble getting my organization game back after a couple of tough years and the bills are still a pain. Limited funds and too many bills. lmao Plus I haven’t had a really good all inclusive tracking system. I am hoping this one will help. I am also thinking of reusing an index card box as a ticker of sorts. I have a long one I use for my Scentsy business. Tracking customers.. etc. Some new tricks I’ve been catching the last couple of days are going to help some of the systems I use be so much better. Thanks so much for sharing.