Are you a biweekly budgeter looking for some savings challenges to save big money this year? Check out these 6 month and 26 week savings plans to save $1000, $5000, and $10,000!

Table of Contents

What is a Money Saving Challenge?

A money saving challenge is simply a challenge (goal) that you set out for yourself to save a certain amount of money.

These are wildly popular and if you search Google or Pinterest you are almost guaranteed to find one to fit your money saving goals.

How much of your paycheck should you save biweekly?

Many financial experts and gurus recommend saving 20% of your income.

And while I think 20% is a great jumping off point, I’d recommend considering your current budget as well as your financial goals and let that guide how much money you should save biweekly.

One of my very favorite articles I’ve read was by Mr. Money Mustache and the shockingly simple math behind being able to retire early (if that’s a goal).

The point I’m making is not whether or not you should jump into FIRE, but how important it is to let your goals drive your financial decisions.

Depending on your current financial situation, you may have to baby step into where you want to be– build up to it– but reverse engineering your numbers will serve you far better than picking an arbitrary percentage that a random “finance expert” gave.

Remember, personal finance is personal. Current income, cost of living, expenses, day-to-day needs– all play a part in your financial picture.

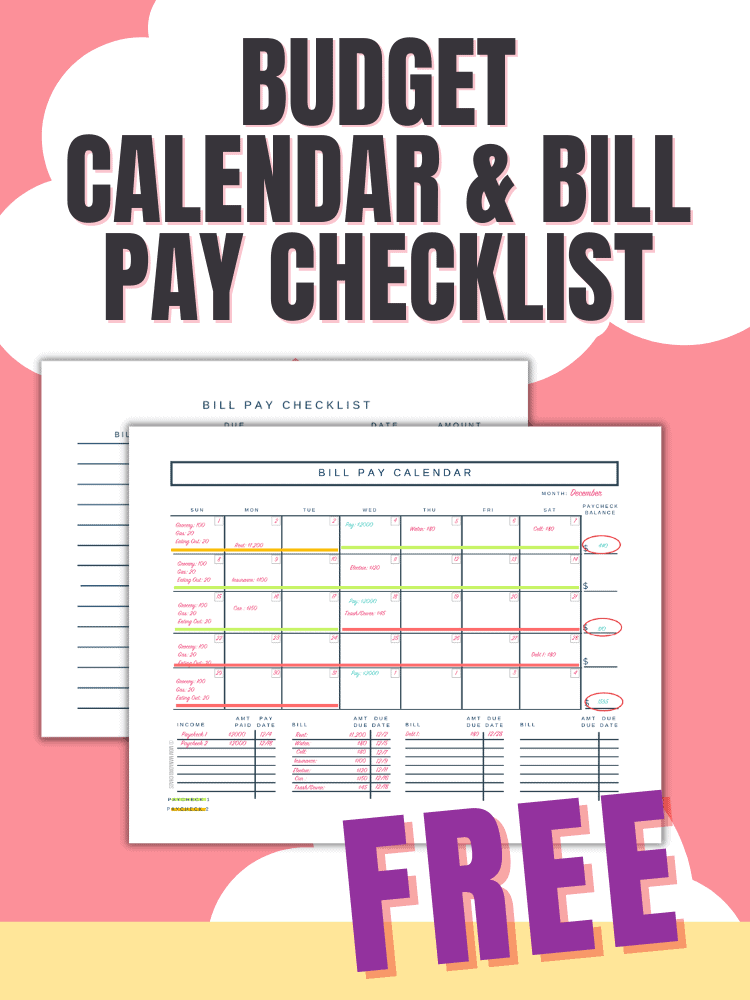

DON’T MISS IT!

Drop your email address below to grab your free Budgeting Calendar and join a community of 36K other busy budgeters!

By entering your email address, you are agreeing to our Privacy Policy and European users agree to the data transfer policy.

The Magic of a High Yield Savings Account to Save More Money

There are two things to keep in mind when planning out your success with theses money challenges:

First, you will greatly improve your odds of success by paying yourself first when you get your paychecks. If you wait to pay yourself with the leftovers—you get the leftovers!

Second, I would highly recommend that you save for your challenge in an account where you won’t be tempted to touch it and preferably something that earns a little interest, like a high yield savings account.

Two banks that I often use for my savings goals are Ally Bank and Capital One 360 Savings accounts. I’m not an affiliate for either, just a happy customer!

High yield savings accounts, like the ones I mentioned above, typically have a higher annual interest rate than your typical savings accounts and because they are not my everyday bank, it really helps to solidify those funds as a separate entity and adds another step if you find yourself tempted to dip into savings.

Bi weekly Savings Plans

Now that you know what a money saving challenge is, you need to decide what your savings goals will be for your challenge.

In this article we will focus on saving $1000, $3000, $5,000, $10,000 and a few of other variations.

If you are interested in customizing these biweekly savings plans, you can grab the digital versions of them below for just $5 .

If you just want to grab the printable PDF versions, you can grab those below as well!

26 Week Money Saving Challenge – Saving $5000 in 26 Weeks

So you are a bi weekly budgeter and you want to save $5000 this year.

In this challenge you will be saving $190-$195 every other week.

So what does this look like?

- Week 1: Save $95

- Week 2: Save $95

- Week 3: Save $98 (rounded up)

- Week 4: Save $98 (rounded up)

Now you may be thinking almost $100?! I’m just barely keeping it together, how am I going to find $100?

When you are struggling with not having enough money in your budget: you have two options when it comes to saving money.

Option 1: Decrease expenses

Option 2: Increase income

With that in mind, you can either find ways to decrease some of your monthly bills OR find a way to make a little extra cash.

More on these down below.

Check out this 26 Week $5000 Savings Challenge Printable (PDF):

26 Week Money Saving Challenge – Saving $10,000 in 26 Weeks

Doubling your savings from the previous challenge- $10,000 in a year.

In this challenge you will be saving $375-$400 every other week (or each paycheck).

So what does this look like?

- Week 1: Save $200

- Week 2: Save $200

- Week 3: Save $188 (rounded up)

- Week 4: Save $188 (rounded up)

Check out this 26 Week $10,000 Savings Challenge Printable (PDF):

How can I save $3000 in 6 months biweekly?

Similarly to the $5000 savings plan, in the 6 month version you will be saving around $230 every other week.

- Week 1: Save $115

- Week 2: Save $115

- Week 3: Save $116 (rounded up)

- Week 4: Save $116 (rounded up)

Since you are saving money in half the amount of time, you will be using 13 paychecks instead of the traditional 26 for the year.

This may be a little more challenging for tighter budgets.

Check out this 6 Month $3,000 Savings Challenge Printable:

DIY Bi weekly Savings Plan

If you’ve been budgeting your biweekly paychecks for more than a minute, you know what a challenge it can be some months to make your income and expenses work together seamlessly.

My first suggestion would be to take a look at your budget and see currently where and when you have extra money you can throw towards your savings goals.

If you know that you have an extra $25 you could put towards your challenge, start there.

If you are able to cut back expenses or make a little extra cash, you can add that in as well.

The point of a DIY biweekly savings plan is to make a plan that works with your budget.

Here are two other printable PDF variations you can grab for your own.

Grab your $1000 savings plan for 26 weeks (biweekly paycheck).

Save $1755 in just 26 weeks with this Biweekly Savings Plan!

What to Do with that Extra Third Paycheck?

If you are paid every other week (bi-weekly), you will typically have two paychecks a month, but at some point will find a few months with three paychecks, pay schedule depending.

If you aren’t sure what months those will be– the quickest way to figure this out is by grabbing a calendar and dropping the days on there.

So on those months that you receive an extra third paycheck– what should you do with that money?

The best place to start is by taking a look at your savings goals and start prioritizing where that money could best be put to use.

- Do you need to fund your emergency fund?

- Do you any high interest debt that you want to pay down?

- Could you make extra mortgage payments

- Are you saving for a large upcoming expense?

Bottom line–What is going to serve you best in your financial future?

How to Find More Money to Save.

Now that you know what a money saving challenge is and that you want to save $5,000, you make be wondering how you are going to make this work with your budget.

You have two real options when it comes to increasing your savings. You can either cut expenses or you can increase your income.

Cutting Expenses

Let’s take a quick look at a few common places people tend to overspend. If you want a more in depth look at where you can cut expenses, check out my favorite ways to cut expenses.

Food

One area where most people struggle is with budgeting food. Whether that’s meal planning or eating out.

So if you are looking for a starting point, this would be a great place to begin.

Entertainment

While $7 and $10 a month on subscription services may not seem like much, they definitely add up over time. Books, movies, concerts. If you are willing to put in a little work there are almost always free or cheaper alternatives.

Books: go to the library or used book stores.

Movies: Redbox is $1.75. Definitely cheaper than going to the movies or renting from Apple TV/ Amazon etc.

Concerts: Check your city’s websites. There are often free festivals and events.

Housing Costs

I know this seems like a crazy budget line to include, but for most people housing is their largest expense.

I’m not just talking your rent or mortgage payment, although that is a good place to start. Take a look at your utilities, insurance, etc.

Am I recommending you go out and sell your house? No. Each family’s financial situation is different. But consider if you are a family of 3 living in a 5 bedroom house that’s eating up 30% of your take home pay. Is that worth it?

If nothing else, I would invite you to take a look at the percentage of your take home pay that your housing costs are consuming.

For those who don’t like math: Just take your rent or mortgage and divide by your total take home pay. That will give you a number with a decimal. Once you get that number, multiply it by 100. Bada bing, bada boom.

People in high cost of living areas I hear you about how crazy housing costs are. I live in a high cost of living area, so I feel you on a deep emotional level. This is not going to work the same for 100% people.

You are just trying to find solutions for your problems.

Disposable products

Want to save money and the Earth too. Consider ditching disposable products and finding alternative options. Check out #4 in my article, Living Super Frugally aka living life on the cheap!

Make More Money

The other option is to make more money aka get yourself a side hustle. Here are a few quick and easy ways to make some extra cash.

This by no means is an exhaustive list, but it will definitely get you started.

Selling your stuff

Facebook Marketplace, Craigslist, Flea Markets, Garage Sales. Take a look around and see if there’s anything you no longer need or use. A pretty simple and straightforward way to make a little extra money.

Sell your services

Dog walker, baby sitter, house sitter, mother’s helper. This has little to no cost to you and is pretty simple to get started.

Become a Driver

Driving for Uber, Lift, Instacart, and there are tons more.

Take Surveys.

Vindale Research , Survey Junkie are just a few. There are tons of survey sites.

No you will not get rich doing surveys, but it is relatively easy money.

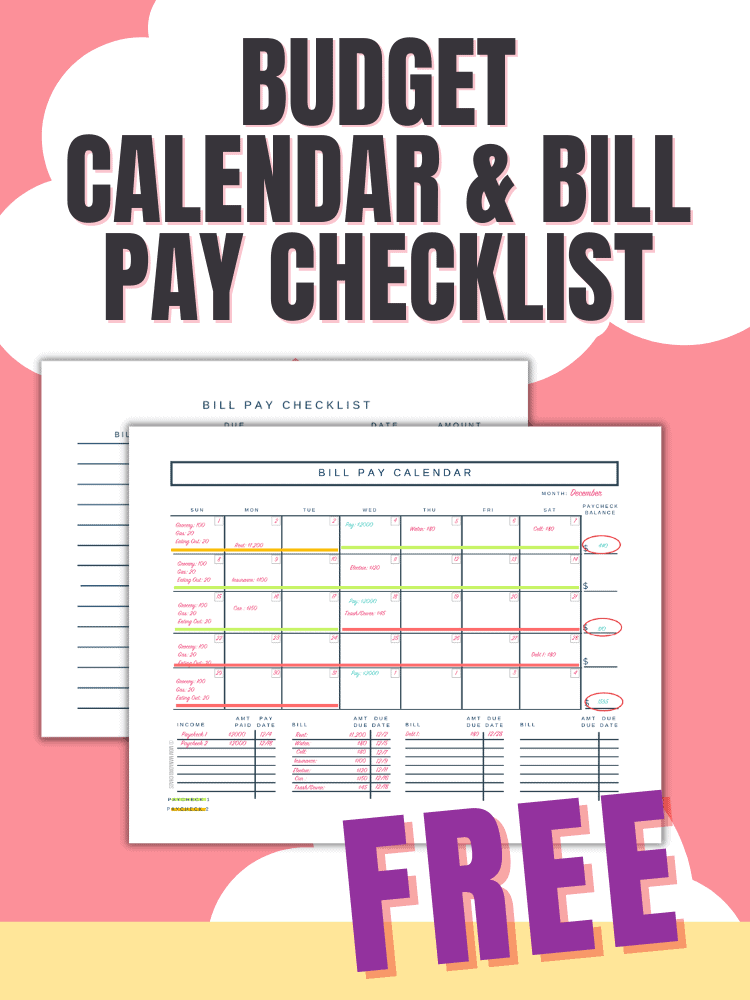

DON’T MISS IT!

Drop your email address below to grab your free Budgeting Calendar and join a community of 36K other busy budgeters!

By entering your email address, you are agreeing to our Privacy Policy and European users agree to the data transfer policy.

Bringing It All Together

Saving money on your biweekly paycheck can be accomplished with a clear plan and consistency. Don’t be afraid to get creative and create a plan that works for you and your budget.

Hi

If it’s bi weekly wouldn’t it be 52 weeks? Or are you supposed to put away money on weeks you don’t get paid as well ?