Putting money aside for long term and short term goals can be challenging for many people. And while it is challenging, it isn’t impossible– let’s talk about what strategies are most effective for saving money.

This guide can help you set simple, yet realistic and achievable savings goals.

Table of Contents

# 1: Track your spending.

Tracking your spending is probably one of the most dreaded three words for most people digging into their personal finances.

It feels tedious. It can feel stressful. It may even bring about feelings of embarrassment or shame. But without this crucial first step, it will be a struggle to really come up with an efficient and effective plan.

Going through your checking account from the last few (read: 3-6) months will give you a strong picture of just where your money is going.

The key here is organizing your spending so it’s in a usable format so that you can jump into #2 ready to go.

[elementor-template id=”5102″]

#2: Make a plan for your money

It’s important that you have a plan to help you reach your financial goals (both long term goals and short term goals) as well as a plan for how you plan to spend the money you have coming in.

Whether that’s paying off high interest rate credit card debt, paying down student loans or starting saving for retirement.

The plan is key.

This planning session should also include cutting back expenses where you can to increase the amount of money available to help you further your goal of saving more money.

And it should include prioritizing your goals.

When you have limited funds, it’s important to know what needs to be funded and the time frame.

#3: Start saving money for emergencies.

Life can happen fast. At some point you’ll experience a financial emergency and you don’t want to show up unprepared with empty pockets.

Worst case scenario, you’ll have to turn to high interest debt, compounding your problem.

If you are new to emergency funds, check out my definitive guide to emergency funds.

#4: Pay off high cost debt.

One of the best ways you can save money is paying off high interest debt.

It may feel counterintuitive to put off saving or saving less to attach your debt, but the math is pretty clear when you compare a credit card with 19.99% interest rate with even a high yield savings account with 1.8% return.

While you don’t have cash accumulating in your account, the faster you dump that debt, that’s more money in your pocket in terms of saving on money that would be going to interest payments.

#5: Automate saving money

Almost all banks now offer the ability to automatically transfer money.

But why does automating the process help you save money? Treating paying yourself first like a bill helps you to prioritize the savings and automating makes sure that it happens.

What you don’t see, you (ideally) won’t miss and you are far more likely to be able to hold on to that cash.

[elementor-template id=”5102″]

#6 Small measurable goals at the start.

If you are new to saving or you are starting on a very tight budget, it can feel like a few dollars here or there may not really matter or help you reach your goals.

But the truth of the matter is one of the most crucial strategies to allow you to save more money is by creating a consistent habit.

Maybe all you’ll be able to save now is a few bucks here or there.

Maybe you are having to create (i.e. a side hustle) the money so that you can put money away into savings.

The key here is to create a solid habit and to slowly increase your savings as you are able.

If you can only afford 5% of your monthly income, try in a few months to bump it up by 1% and keep slowly increasing it until you are in a solid position to save what you want to every month.

Another simple and effective strategy for saving money is to try savings challenges. They can be customized to fit your budget or you can grab some made for you money saving challenges.

#7: Making money saving simple

The purpose and time frame of your goals will dictate (to some extent) where you need to park your savings.

Short term goals need to be more liquid and should be kept somewhere the money can still earn (hopefully!) some interest like in a savings account, high yield savings account, or CD’s now have short term offerings.

Long term savings goals can be invested in FDIC insured retirements accounts (like Roth IRA’s), or in stocks, mutual funds etc.

It is 100% worth speaking with a financial advisor to figure out what products and services will be the best fit for you and your financial situation.

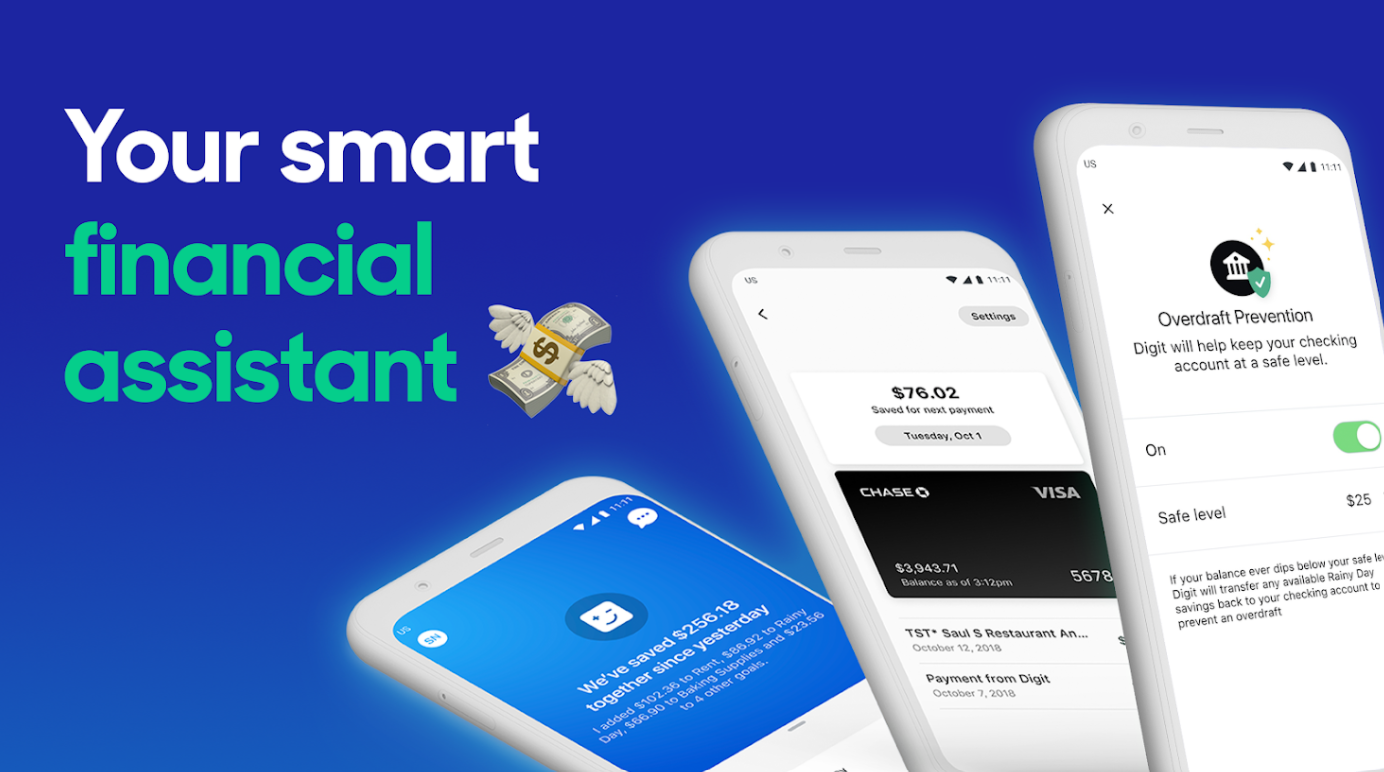

Another effective yet passive way to making saving money simple is with one of my favorite money apps, Digit.

You connect your bank account to Digit, and based on an algorithm, they are able to automate savings transfers into your Digit Savings account.

I love Digit for so many reasons.

- It’s automated.

- Digit saves a tiny bit every day so it doesn’t feel like you are saving (even though you are!

- You have unlimited goals

- No account minimums

- Overdraft reimbursement (they pay the fee if they save too much)

- 0.5% Savings bonus every 3 months.

According to their website most people save about $2,500 a year! What could you do with an extra $2,500?