If you are new to every other week paychecks, you may be wondering, what’s the best way to budget for biweekly paychecks and monthly bills? You may be surprised just how simple it really can be.

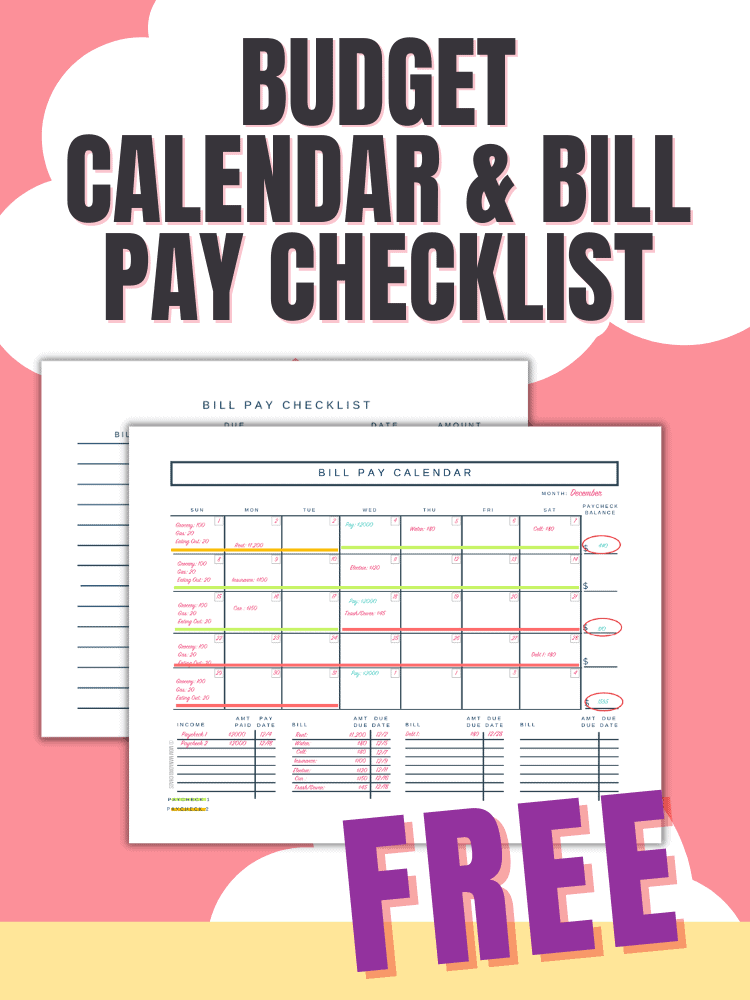

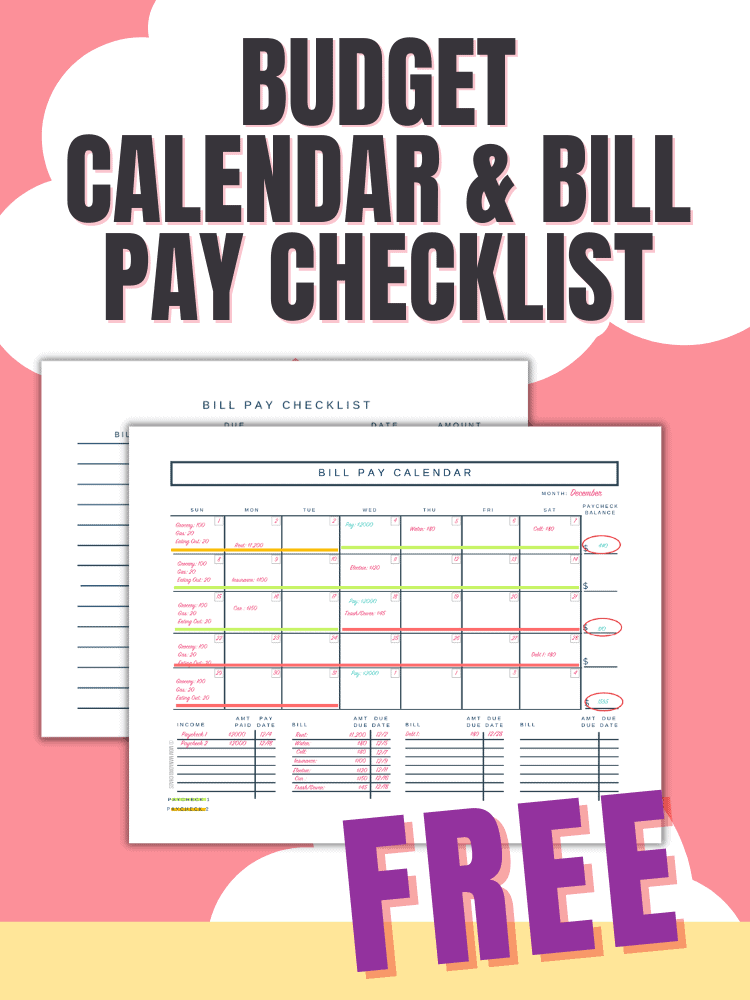

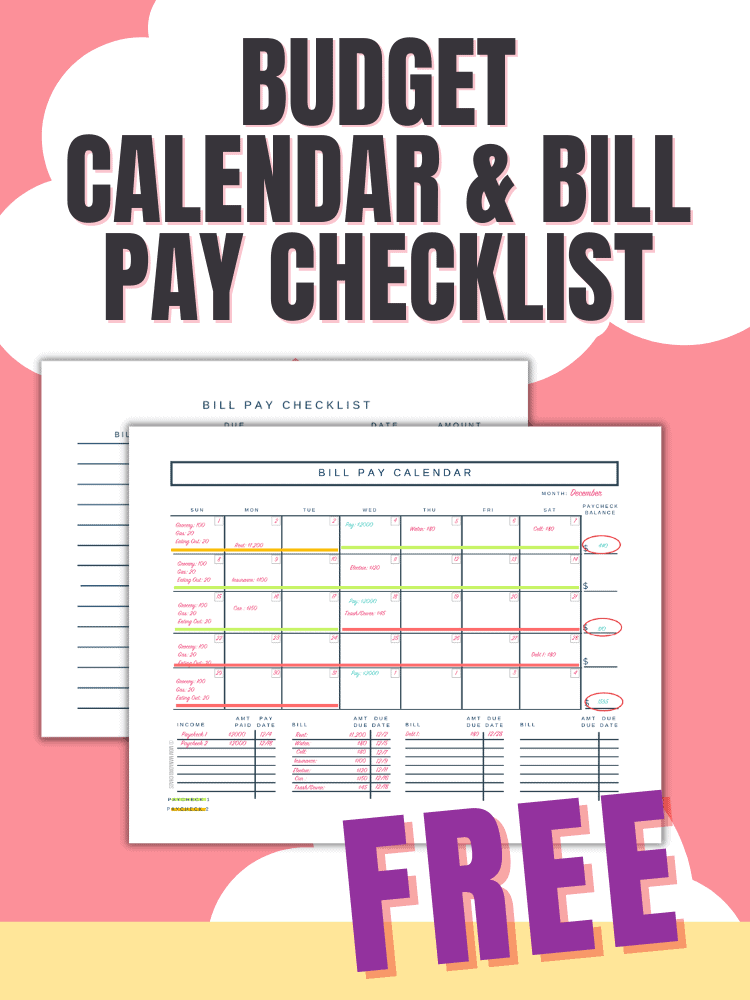

DON’T MISS IT!

Drop your email address below to grab your free Budgeting Calendar and join a community of 36K other busy budgeters!

By entering your email address, you are agreeing to our Privacy Policy and European users agree to the data transfer policy.

Table of Contents

How to Create a Biweekly Budget with Monthly Bills

What makes biweekly budgeting a little special is that your paydays are going to be on different days of the week every month.

Getting paid biweekly means you are getting paid twenty-six times a year.

Occasionally, depending on how the calendar falls, it can be twenty-seven, but for planning purposes– twenty-six.

That means twice a year you will be getting an extra paycheck. We’ll talk more about what to do with these paychecks later in the article.

So how do we make monthly bills and biweekly paychecks work together?

Let’s check out what you need to be successful with your new budget!

Step 1: Create Your Monthly Budget Categories

Getting paid once a month, twice a month, every week doesn’t matter. You need to know where your money is going, so start by listing out your monthly expenses, including due dates.

Groceries. Utilities. Mortgage payment. Gas. Insurance. Car Payment. Cell Phone. Internet. Haircuts. Clothing. Gym. Credit Card debt payments.

Once you know what money you need, you will be in great shape to organize yourself and your money to rock your month!

Step 2: Organize Your Bills and Expenses Utilizing a Bill Pay Calendar

Google Calendar is a fantastic free tool to help keep your finances organized and on track.

I use it daily to help me stay on top of the rest of my daily life, and budgeting is no exception.

Part of it is that the visualization really helps me understand what’s happening each month and the bonus of getting the email reminders, so I don’t forget due dates and how I’ve allocated funds in my budget.

If you want to get a jump start with getting your money organized, be sure to grab your very own budgeting and bill pay calendar.

DON’T MISS IT!

Drop your email address below to grab your free Budgeting Calendar and join a community of 36K other busy budgeters!

By entering your email address, you are agreeing to our Privacy Policy and European users agree to the data transfer policy.

It’s a great way to get a snapshot of your monthly budget and an easy way to check for places your month is outpacing your money.

If you are looking for a biweekly budget template, one is included in Biweekly Budget Blueprint planner.

This budgeting planner was designed specifically with biweekly budgeters in mind. It includes over 100 pages of tools, trackers, and more to get ahead with your money.

It also includes a monthly budget based on a biweekly pay template made in Google Sheets (or Excel, if you prefer) are available.

Be sure to check it out if you are ready to move to the next step with your finances.

Step 3: Create a Zero Based Budget for Each Paycheck

With a zero-based budget, you’re going to look at your income and expenses and give every dollar a job to meet your financial obligations and reach your financial goals for the future.

When your paycheck comes in, you are going to assign 100% of your income to an expenses or category until you have planned out every dollar.

Before you start getting panicky, please realize that just because your budget is planned down to zero, doesn’t mean you are left with zero dollars at the end of that paycheck cycle.

Rather it means you are utilizing every penny to it’s maximum and most efficient potential.

Something else to think about is to consider breaking larger expenses into 2 payments. Expenses like your mortgage payment.

It can help keep a more even budget across the month when you create half payments for large expenses– this method is called the half payment method.

Super simple. Super effective.

Step 4: Tracking your money

Tracking where your money has gone is typically where most people get frustrated and bail, but this is a super important step in sticking with your budget and subsequently meeting your personal finance goals.

One of the reasons I really love having my bills in a separate checking account from discretionary income is that I always know that the money in my second (discretionary account) is where I really need to focus my tracking and I know I’m not in danger of spending money I need for my bills.

Some people really enjoy the 50/30/20 Budgeting method because they can give themselves permission to spend that 20% of wants any way they like and they call it good.

People who are on tighter budget can do well with cash budgeting and using envelopes. This form of budgeting makes it really hard for you to accidentally overspend categories.

No matter where you land with your tracking tactics, it’s important that you have one and are consistent so you can win with your money!

Bonus: What Else You Need to know about biweekly budgeting

Why you should consider saving up to cover a month’s expenses…

A goal of mine is to save up enough money for a month’s worth of expenses. I can’t imagine too many things more stressful than living paycheck to paycheck. Getting a month ahead helps to alleviate the stress for a few reasons.

First, you won’t be getting paid on the same day of the month every month, but typically bills are due at the same time every month. So, if you are a month ahead, you will always have the money ready to pay bills as they are due regardless if you are getting paid during the first or second week of the month.

You have the flexibility to pay when it best works for you and the due date versus being forced into a certain window because of your ever-changing pay date.

Second, peace of mind. If anything unexpected pops up you have time to adjust for that change.

A word of caution– this is not a free for all pot of money. The purpose of this fund is to maximize your flexibility in paying bills. This is also not an emergency fund.

Check yourself, before you wreck yourself!

When you are planning to get a month ahead. You don’t necessarily need to save a months worth of salary– you just need to save enough to cover your necessary expenses.

The point is to have the money to cover next months bills.

I have a baseline budget that consists of just what I need to get by. It doesn’t include entertainment or eating. It doesn’t include any money that I don’t absolutely need.

You want to make sure you have the money for rent, utilities, cell phone, etc. Anything above necessities is a luxury and those are things you could forgo if the money wasn’t there.

Related Biweekly Pay Article: Saving $5000 in 26 weeks

How to help you get ahead of your monthly bills….

If you are on a super tight budget there are tons of options to help yourself get ahead.

Temporarily cut back on other discretionary spending.

- Pick up a side hustle: dog walking, lyft, babysitting, mother’s helper, etc.

- Sell stuff. Check out Ebay, Craigslist, FB Marketplace, or hold your own garage sale.

- Online surveys. Some of my favorite are Swagbucks, Survey Junkie, and Inbox Dollars.

DON’T MISS IT!

Drop your email address below to grab your free Budgeting Calendar and join a community of 36K other busy budgeters!

By entering your email address, you are agreeing to our Privacy Policy and European users agree to the data transfer policy.

What to do with your 2 extra biweekly paychecks during the year?

As I mentioned above twice a year you will get an extra payment.

Here is a list of a few ways you could use those paychecks to get ahead in your financial goals:

- Pay down debt

- Save up to get a month ahead for expenses.

- Put money away for retirement.

- Add extra to your sinking funds: new car, vacation, home/auto maintenance, etc.

- Pay an insurance policy (auto, home, life)

- Grow your emergency fund

- Pay/plan ahead for irregular expenses.

Pitfalls with Budgeting Biweekly paychecks

There are a few areas you need to be aware of when you are trying to balance getting paid every other week.

The Two Extra Paychecks. As I mentioned above, your occasional third paycheck isn’t intended to be a free for all, so much as a potential windfall to help you get ahead. Don’t squander the opportunity.

Failing to plan for the month. You need to be diligent about laying out your whole month, so you don’t run out between payday. This is why I strongly recommend using a calendar to really visualize where and when money needs to be spent.

How do you budget bi weekly? Any tips or hacks to share? I’d love to hear from you, please comment down below.

This is a very informative post. Personally I couldn’t manage without a budget.

Thank you so much! I couldn’t agree more. Having a budget is so important when you are taking control of your money. Cheers!

I get paid semi-monthly 5th/20th and husband gets paid bi-weekly. Any budgeting ideas/must-dos for a beginner?

Hi, Allison. What a great question!

My family has been getting paid semi-monthly and bi-weekly for the past few years and I’ve found that the best thing you can do is to get organized with your income and expenses.

I started out by making a list of all of my expenses and their due dates so I could see how much money was due each week. There is a printable bill pay tracker in my resource library, but you could just as easily make a list on a regular ole sheet of paper.

Then, I put all that information on a calendar (I used Google Calendar but you could just print one out or DIY). Next, I put our paychecks and the amounts on the calendar and started divvying up what is getting paid during each pay period and then making notes if a certain paycheck was going to be short so I could set money aside from a previous paycheck. I also include weekly needs for gas, groceries, etc so that everything is accounted for.

The absolute best way is to get a month ahead so that you are paying this months bills with last months paycheck. It makes paying bills and planning out your budget tons easier and really helps to alleviate the stress and feeling of living paycheck to paycheck. But depending on your financial situation, it could take some time to get to the point where you are a month ahead.

My last tip would be to make sure that you each know, based on the budget you made above, what you are getting for spending each week so you don’t accidentally overspend your budget.

I use a hybrid version of the cash envelope system–paying some bills electronically and some cash.

I’m the one who does all the grocery shopping, etc. So I organize my money by week instead of just a monthly envelope. If one week I have mine and my husbands paycheck hit– that usually means I’m making 2 weeks of grocery shopping envelopes, I’m setting aside money for gas for the following week, etc. because I know the following week, we won’t be getting paid.

The benefit of the list of bills is to help you plan ahead so you aren’t ever going to be short.

Let me know if you have any other questions. I hope this helped!

Cheers!

I’d love for you to share with me the bi weekly budget template.

Hi Amy! All of my budgeting templates are in my resource library. If you check out the menu bar there is a sign up for the resource library. Hope this helps. Cheers!

My employer recently changed from a bi-monthly to a bi-weekly pay. I’m a single mom with one income. My co-workers petitioned for the change. They want that 3rd pay twice a year. No one seems to understand that in order to get that 3rd paycheck twice a year, the other 10 months of the year my budget (and theirs) is $175 less. When you are pinching pennies to buy groceries, $175 is HUGE! I just skimmed this article, but I’m saving it to read when I have more time. I hope it helps!

Hi, Jodie! Switching from bi-monthly and bi-weekly pay is a big change. We went through something similar when switching jobs and really had to think through how we were going to make all of it work. $175 is huge for some families! Once you decide to dig in, I’d love to hear from you. Good luck!!

Hi Melissa, It is in the top row of Printables section called “Bill Pay Calendar Printable”.

I’m in the early stages of the half-payment budgeting system. I really like your take on using Google Calendar to track paydays, bills, as well as events; however, I downloaded the app for iPhone and once I logged in, I have NO IDEA how to use the app! Do you have a tutorial or do you recommend only on a desktop? I think implementing that into my budgeting plan would be really beneficial. Please help!

HI Monique! Setting this up on your desktop would definitely easier. You can do the same basic things on both : you can set up reminders, add color labels, etc., but it feels more intuitive and user experience (at least for the set up) is better on desktop. If you are just wanting to track bills (internet, utilities, cell phone, etc) and income that is definitely simple enough to add through the app, but if you are wanting to track daily spending, it might be easier through the desktop.

I don’t have a tutorial, but that is something I will definitely look into for the future. I’d never considered that as something that people might want to see.

Just the quick basics for using the app/desktop:

1. I find it so much easier to look at the month view to start before narrowing down to week/day. It feels very disorientating (at least for me) to start with the daily tab when I”m looking at money stuff.

2. Create a calendar for each thing you want to track and then color code your “calendars”. Events= Color 1, Paychecks = Color 2, Bills= Color 3. That way if you are wanting to look at something quickly, you can toggle off the distractions of the other categories and just focus in on what you need to see.

On the desktop, on the left hand side you’ll see a collapsible menu called “My Calendars”. Underneath it you’ll see something called, “Other Calendars” and a “+” sign. You can add things like Bills, Paychecks, Events, Classes, etc all as separate calendars.

Even though you are creating separate “calendars” they are all visible simultaneously as long as you have check-marked their name.

3.Reminders are your best friend when it comes to managing due dates or making sure you don’t forget something. (https://developers.google.com/calendar/concepts/reminders)

Please let me know if you have any other questions or want me to deep dive into anything. I’m Google Calendar obsessed! =)

Thank you for the input!! A tutorial would be FANtastic! Your tips for the basics helped tremendously. Only question so far is if there’s a way to grey out or strike out a bill once it’s paid/cleared…I’m using the description to keep tabs on where the bill stands in the meantime, which will suffice. Looking forward for your reply!

Oh! I thought of another question — is there a way to link my Facebook calendar to it so all my events can automatically be there? I know there must be a way, as I’m following the calendar of a page I follow; not even sure how that was set up.

HI Monique,

I don’t use this feature, but I did find this article through FB on how to link to different calendars. https://www.facebook.com/help/152652248136178/

Hope this helps!

Kristen

There’s not a way to strike it (that I’ve ever seen anyway), but you can create another calendar for “Paid” and once, you’ve paid the bill you can switch it from “Bills Due” to “Paid” Calendars (does that make sense?) and then you’d have a record. You also have an option to make a copy of an event to a different calendar so you could keep the “Bills Due” event and once you’ve paid it, duplicate it into the “Paid” calendar.

Another thing you can do is in the description, if you have any confirmation #’s, Check #’s etc.you can mark them there to keep them for historical record.

My husband and I both get paid bi-weekly. After I set up my budget for the month I determined how much was needed to be set aside each paycheck. I used the cash envelope system and marked on the envelope how much needed to be put in each pay period. When my envelope has the full amount of the bill due, I deposit that money into the bank and pay the bill. This has been working really well for us. Like you said, two times a year we have an extra pay period. The one in the middle of the year can go for vacation spending and the one at the end of the year can be used for Christmas shopping. This helps alleviate the need to try to save for these things throughout the year.

Wow, Cindy! That sounds like a great system that’s working well for your family. I really, really love using envelopes with budgeting. It’s truly one of the best and easiest ways to stay on budget. Thank you so much for your awesome tips!

This is the first time I’ve ever thought about using Google Calendar to organize bills. It’s brilliant! I like to keep everything in a spreadsheet, but I look at my calendar all the time… so it would be a wonderful reminder. Totally awesome! Thank you!

First, let me start off with a huge THANK YOU for your willingness to share. I’m so grateful that I stumbled upon your blog. I was praying about a different way to manage what I have, with a new budgeting system. I’m excited to be apart of this journey and I thank you for your wisdom.

Hi Briana,

I’m so happy you found this helpful! I can’t wait to hear how this works for you! Please let me know if you have any questions.

Cheers,

Kristen

Kristen, I recommend a low credit balance card for groceries. I have used one for years. It helps you to budget an expense that can easily get out of hand and keep your spending to a limit! And easier to pay off balance every month!! Linda

Very interested in the bi weekly sheet please!

HI Kayla!

All of my free templates and printables are in my Resource Library. If you go up to the big red box and sign up, the address to the library and password will be sent to you. Please let me know if you have any other questions.

Cheers,

Kristen

Hi, Joanie,

The templates are available in my resource library, if you are interested in joining, just fill out the red subscriber box above.

Cheers,

Kristen

Hi, I just found this site and believe it will be very useful. I downloaded the Bill Pay Calendar, but it does not look the same as the one in this post. There isn’t the extra column for the paycheck balance at the end of each week. Is that template available? I looked for it in the resource library and did not see it.

Thanks for your help!

Rebecca

Hi Rebecca, the sample bill pay calendar which was used as an example has the extra column to keep the example easy to read and understand. However, if you send your email address to kristen {at} mommanagingchaos.com I can modify the example and send you a blank template. Cheers, Kristen

Ohhh, I love this and thank you for the template! I feel this is slightly different then all the other budgeting information out there and this feels more like something I can stick with! I love the idea of having a sinking fund AND an emergency fund. I always felt that I had to use my emergency fund for tires or larger purchases because I never saved for them. Also, instead of the cash envelope system, which is something I have tried multiple times and cannot stick with it, I love the idea of have 2 separate checking accounts…one for bills and one for discretionary spending!

Thank you!!!

Kristy